Algorithmic trading is the use of programmed computers to execute specific actions in response to different market data. An example of this is writing an algorithm and instructing a PC to buy or sell stocks for the user, at a super-fast speed that is not possible for a human trade.

It’s when the specific conditions are met. Many sites, such as TriForce Traders, inform individuals about this phenomenon to their advantage.

To learn how to do algorithmic trading, you must also know the different strategies incorporated by it.

What are the different types of strategies in Algorithmic Trading?

The market is a game, and to win any game, you need a strategy. The basic principle of an excellent algorithmic trading strategy is to find opportunities that increase income and at the same time, reduces cost. The various types of algorithmic trading strategies are as follows:

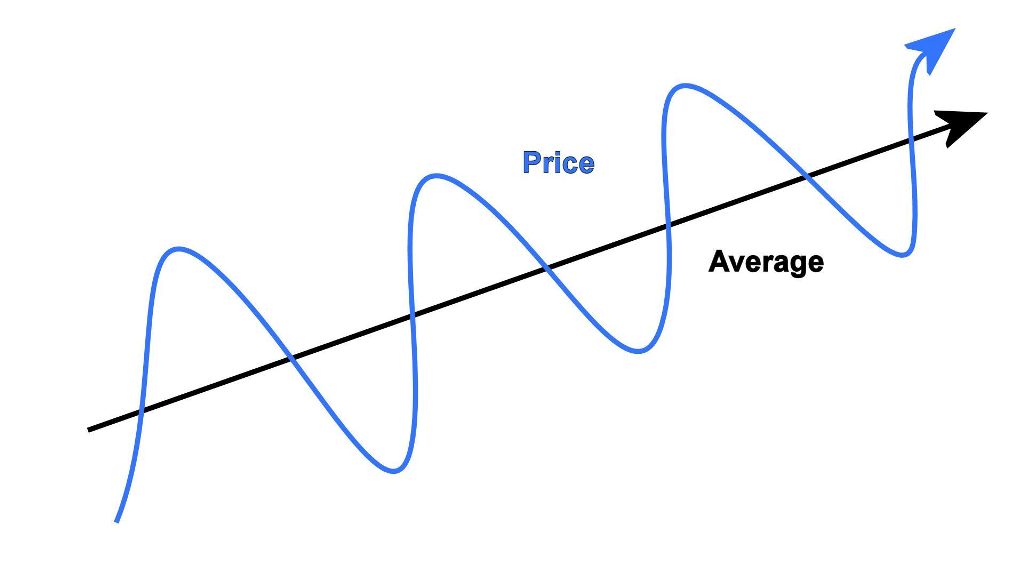

Mean Reversion

A universal principle and assumption in stock trading mean that stock prices will return to its average after encountering drastic price movements. Many traders bet on such a strategy by immediately buying a stock after facing a drastic fall in its price. Afterward, traders will then wait and sell such stock after it returns to its average, which then provides additional profit.

Trend-following Strategies

With the accessibility of data, algorithmic trading strategies have turned to trends to help predict and analyze future market movements.

Arbitrage Opportunities

Arbitrage happens when an asset is purchased at a similar time to two different markets, one price of which is higher than the other. It provides a way to ensure prices do not go significantly from fair value for long periods.

Momentum

Two things are essential to momentum trading: market trend and market sentiment. The goal is to find patterns that indicate a continuing trend in one direction or another and then to capitalize on it.

Time Weighted Average Price

This strategy breaks down large orders and releases them in smaller portions to the market at a given time interval to lessen any market impact. It is done to make sure that the price is closer to the average rate.

Scalping

The use of scalping as an Algo trading strategy is not far too common. Not many traders opt for such because it only involves small profit, albeit obtaining it for a short timeframe. Such utilization of small price changes in the market, however, is an excellent way to ensure that the risk of profit is not all that big.

Algorithmic trading is an ongoing popular trend in trading that takes out human involvement and focuses on programmed computers that execute specific actions when met with certain conditions. It has widely changed how people deal with stocks and how companies do trading.

However, algorithmic trading will only develop alongside technology. It is exciting to see how advanced and convenient the next trading platform would be. Algorithmic Trading, just like many things, can be complicated at first, but with the proper guidance, one could master it.